In today’s rapidly shifting market landscape, understanding what belongs in your portfolio — and what doesn’t — can make all the difference between steady growth and costly mistakes.

Eric Fry tackles this challenge with a straightforward, action-driven philosophy built around a practical “Sell This, Buy That” framework. The goal is simple: move capital away from vulnerable, overextended stocks and reposition it into companies with stronger upside potential.

But how effective is his approach in real-world conditions? In this review of Fry Investment Report, we’ll take a closer look at what the service delivers, how it operates, and whether it aligns with your investing goals.

Fry Investment Report is a monthly investment advisory service led by veteran market analyst Eric Fry. The report focuses on identifying high-growth opportunities driven by major technological, economic, and global trends — while also warning readers away from overhyped or weakening stocks before sharp downturns occur.

Each issue delivers clear buy and sell recommendations, in-depth research, and updates to a model portfolio designed for long-term wealth building. Rather than chasing short-term market noise, the strategy emphasizes spotting transformational companies early and managing risk proactively.

Subscribers also gain access to archived reports, ongoing market commentary, and performance tracking. Overall, Fry Investment Report aims to provide practical, disciplined guidance for investors who want to stay ahead of major market shifts without relying on guesswork or speculation.

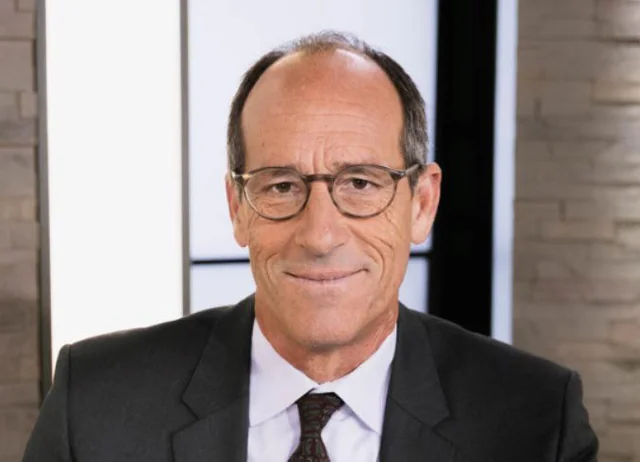

Eric Fry has more than 30 years of experience studying the stock market and helping investors understand changing market conditions. He is known for spotting strong opportunities early and warning readers before risky stocks fall.

Over nearly two decades, Eric focused on international stocks, building deep expertise in global markets before moving into professional portfolio management for another ten years.

His background later led him to work alongside James Grant at a respected Wall Street publishing firm, where he helped create research and commentary for professional money managers.

In 2016, he gained wider recognition after winning the industry’s highly regarded Portfolios with Purpose competition, outperforming hundreds of well-known investors.

Eric is widely regarded for his disciplined, independent style — blending big-picture economic insights with detailed company analysis.

Today, as the editor of Fry Investment Report, he turns decades of experience into straightforward, actionable guidance designed to help subscribers invest with greater clarity and confidence.

When it comes to choosing a market expert to follow, experience and proven performance make all the difference. Eric Fry has built his career over several decades, studying global markets and uncovering growth opportunities across different economic cycles.

Throughout the years, he has become known for recognizing major market transitions early — especially in fast-moving technology and infrastructure sectors. His skill was publicly demonstrated in 2016 when he outperformed hundreds of professional investors in the Portfolios with Purpose challenge, earning top honors for portfolio performance.

While every investor faces wins and losses, Fry long-term results, transparency, and leadership in financial research point to a trustworthy and established presence in the investment publishing industry. For those interested in big-picture trend investing backed by analysis, his background provides a solid foundation of confidence.

At the core of Fry’s Investment Report is a practical strategy built around constantly adapting to changing market conditions. Instead of holding stocks indefinitely or reacting emotionally to headlines, the system focuses on regularly reassessing which investments still offer strong growth potential — and which ones are becoming riskier over time.

Led by Eric Fry, the approach works by rotating capital out of weakening companies and into sectors showing real momentum. This could mean selling stocks facing rising competition, shrinking margins, or slowing demand, while buying into industries benefiting from powerful trends like technology infrastructure, automation, and expanding energy needs.

What makes the system effective is its balance between opportunity and risk management. It does not rely on predicting short-term market moves. Instead, it tracks long-term economic forces and company fundamentals to guide smarter decisions.

By following this structured method, investors avoid staying stuck in outdated winners and position themselves for future growth. Over time, the Sell and Buy system helps create a more resilient, forward-looking portfolio built for evolving markets rather than past success stories.

InvestorPlace Media is a well-established financial publishing company known for delivering stock market research, newsletters, and investment education to everyday investors. With more than 40 years in the industry, it has consistently provided market insights covering a wide range of investing strategies and economic trends.

In 2017, the company transitioned under new ownership through S&A Holdings, LLC, while maintaining much of the editorial talent and analytical approach that built its reputation over the decades. Today, InvestorPlace operates as a hub for several experienced market analysts, each focusing on specific areas such as growth stocks, income strategies, emerging technologies, and broader economic movements.

Its long-standing presence and large readership reflect a stable operation within financial media, giving investors confidence in the publishing infrastructure behind the services it offers.

When it comes to market guidance, experience and strategy play a major role. Eric Fry brings more than 30 years of investing experience, spanning international stocks, portfolio management, and financial research. He is well known for identifying long-term trends early, especially in fast-growing sectors tied to technology and infrastructure. His reputation was further strengthened after winning the Portfolios with Purpose challenge, where he outperformed hundreds of professional investors.

Supporting his work is InvestorPlace Media, a financial publishing firm with over four decades in the industry. The company hosts a range of investment experts and produces multiple research services aimed at everyday investors, giving Fry’s newsletter a solid publishing foundation.

At the heart of Fry investing style is a disciplined shift from weakening stocks into sectors positioned for future growth. Rather than holding onto popular names out of habit, he focuses on changing fundamentals and emerging opportunities. His research often highlights industries such as artificial intelligence infrastructure, automation, energy systems, and digital expansion — areas driven by real demand rather than hype.

Through Fry Investment Report, subscribers receive monthly stock recommendations, portfolio updates, research access, and timely alerts. Together, these tools aim to provide clear, actionable guidance while helping investors understand the reasoning behind every move.

Monthly Newsletter Access: Subscribers receive regular issues outlining new stock ideas, macroeconomic insights, and portfolio adjustments. Each recommendation includes detailed reasoning to explain both the opportunity and associated risks.

Model Portfolio: Members gain access to an online portfolio that tracks active recommendations, entry prices, and strategy notes. This provides transparency and allows subscribers to follow the broader investment roadmap.

Research Archives: Past reports and special research briefings remain accessible, offering additional stock ideas and deeper dives into long-term trends. Because many recommendations focus on multi-year horizons, older research may still hold relevance.

Trade Alerts and Updates: Between main issues, subscribers receive alerts when timing matters — particularly when entering or exiting positions. These updates help maintain alignment with the overall strategy.

Customer Support: Dedicated support channels are available during standard business hours, along with email assistance for general inquiries.

Getting the most value from Fry Investment Report comes down to following a structured process rather than reacting emotionally to market swings. Below is a simple five-step approach to help readers apply the research in a practical and disciplined way.

Step 1: Read Each Issue With the Big Picture in Mind

Start by reviewing the full newsletter when a new issue is released. Eric Fry typically explains broader economic trends, sector movements, and why certain industries are gaining strength while others are weakening. This context is just as important as the stock picks themselves because it helps you understand the reasoning behind each recommendation.

Step 2: Review the Model Portfolio for Strategy Alignment

Next, visit the members-only portfolio dashboard. This shows current holdings, suggested entry points, price targets, and exit strategies. Comparing your own investments to the model portfolio helps you see how Fry structures risk and allocates capital across different sectors.

Step 3: Evaluate New Buy and Sell Signals Carefully

When Fry recommends selling a stock or adding a new one, take time to review the supporting analysis. Look at the company’s fundamentals, growth drivers, and risk factors. This helps ensure the move fits your personal investment goals and timeline before executing trades.

Step 4: Act on Trade Alerts Promptly but Thoughtfully

Between newsletters, Fry sends alerts when timing matters. These updates may signal ideal entry points, profit-taking opportunities, or risk-reducing exits. Acting in a timely manner helps mirror the intended strategy while maintaining discipline in volatile markets.

Step 5: Track Performance and Rebalance Regularly

Finally, monitor how your portfolio performs compared to the model portfolio. Periodically rebalance based on updated recommendations and shifting market conditions. This ongoing process helps keep your investments aligned with emerging trends instead of outdated opportunities.

Whether Fry Investment Report is worth it depends largely on your investing goals and the type of market guidance you want. This service is not aimed at aggressive traders chasing quick profits. Instead, it is designed for investors who seek a disciplined, trend-oriented strategy backed by research and long-term thinking. The focus is on identifying emerging opportunities while managing risk, rather than reacting to daily market noise.

Many subscribers appreciate the structured approach that comes with clear buy and sell guidance, a tracked model portfolio, and timely alerts. For investors who prefer a thoughtful process over speculation, this framework can offer real value by helping them stay aligned with broader economic trends rather than short-lived market hype.

The inclusion of regular updates, archived research, and a model portfolio adds practical tools that support decision-making. However, like any investment advisory, results are not guaranteed, and individual performance will vary based on timing, personal risk tolerance, and market conditions.

In summary, Fry Investment Report can be a worthwhile resource for those who value disciplined, long-term research and actionable insights — particularly if you want a structured way to navigate evolving markets rather than guesswork.

Fry Investment Report is a monthly investment newsletter created for individuals who want structured, research-backed stock guidance. It is especially useful for investors interested in long-term growth driven by major economic and technology trends rather than short-term market noise. The service suits both beginners who want clear explanations and experienced investors looking for trend-focused ideas.

The newsletter is led by Eric Fry, a market analyst with more than three decades of experience across international stocks, portfolio management, and financial research. His approach blends big-picture economic shifts with company-level analysis to identify emerging opportunities while reducing exposure to weakening stocks.

Subscribers typically receive a new issue every month, featuring fresh buy and sell ideas along with market insights. In addition to the main newsletter, timely trade alerts are sent when quick action is needed due to market changes. This combination ensures readers stay updated without feeling overwhelmed by daily market fluctuations.

The strategy is primarily built around long-term trend investing. While entry and exit timing matters, most recommendations are tied to multi-year growth themes such as artificial intelligence infrastructure, automation, energy expansion, and digital transformation. The goal is to capture sustained growth rather than quick speculative gains.

Yes. One of the strengths of Fry Investment Report is its clear and educational writing style. Each recommendation explains not just what to buy or sell, but why the opportunity exists and what risks to watch for. The included model portfolio also helps beginners understand proper diversification, position sizing, and strategy execution.

Unlike services that chase hot stocks or daily market hype, Fry Investment Report centers on identifying major shifts in the economy before they fully unfold. The “Sell This, Buy That” approach emphasizes rotating out of weakening positions while moving into sectors showing real demand growth. This disciplined method focuses on risk management just as much as upside potential, creating a more balanced investing framework.

Overall, Fry Investment Report offers a structured and trend-focused approach to investing that goes beyond chasing popular stocks. Backed by the experience of Eric Fry, the service emphasizes shifting capital toward sectors positioned for long-term growth while managing downside risk.

With clear research, portfolio guidance, and timely updates, it provides a practical framework for both new and experienced investors. For those seeking disciplined, big-picture market insight, Fry Investment Report stands out as a thoughtful and data-driven investing resource.